The evolution of algorithmic trading can be traced back to the early 1970s, with significant milestones marking its growth and sophistication over the years. The New York Stock Exchange (NYSE) introduced the “Designated Order Turnaround” system (DOT) in the 1970s, which was a pivotal step in the computerization of order flow in financial markets. This system allowed for the electronic routing of orders to the appropriate trading post. A significant upgrade to this system was the introduction of SuperDOT in 1984, which further enhanced equities trade execution in terms of speed and volume.

Interactive Brokers, founded in 1993 by Thomas Peterffy, played a crucial role in the digitalization of trading. Peterffy had developed the first fully automated algorithmic trading system in 1987, using an IBM computer to extract data from a Nasdaq terminal and execute trades fully automated. In 1996, the launch of the electronic communication network (ECN) Island, further facilitated the availability of electronic feeds for real-time execution price and volume information for subscribed traders.

The late 1990s and early 2000s saw significant regulatory changes that boosted algorithmic trading. The U.S. Securities and Exchange Commission (SEC) in 1998 allowed for alternative trading systems, paving the way for electronic exchanges and the rise of high-frequency trading (HFT). The completion of the U.S. Decimalization process in 2001, changing the minimum tick size, also played a crucial role in encouraging algorithmic trading by allowing tighter spreads between bid and offer prices.

The 2000s witnessed a boom in HFT, with advances in technology and data analysis enabling more sophisticated algorithms and greater market liquidity. Machine learning and artificial intelligence began to play an increasingly important role, enabling algorithms to learn from past market trends and patterns for more accurate and efficient trade execution. During this period, high-frequency trading volume surged, accounting for a significant portion of U.S. equity trading volume.

The 2010 flash crash, a sudden and dramatic drop in stock values, highlighted the potential risks associated with HFT and led to the implementation of new regulatory rules to increase market stability and transparency. This event underscored the importance of robust risk management systems.

In India, the rise of API-based automated trading has been notable in recent years, driven by advances in technology, the proliferation of online brokers, and the popularity of algorithmic trading. The availability of trading platforms offering APIs has made it easier for traders to execute automated trading strategies.

Alternative data has also become increasingly important in algorithmic trading. This refers to non-traditional data sources, such as social media, satellite imagery, and point-of-sale data, which can offer insights into company performance or economic trends.

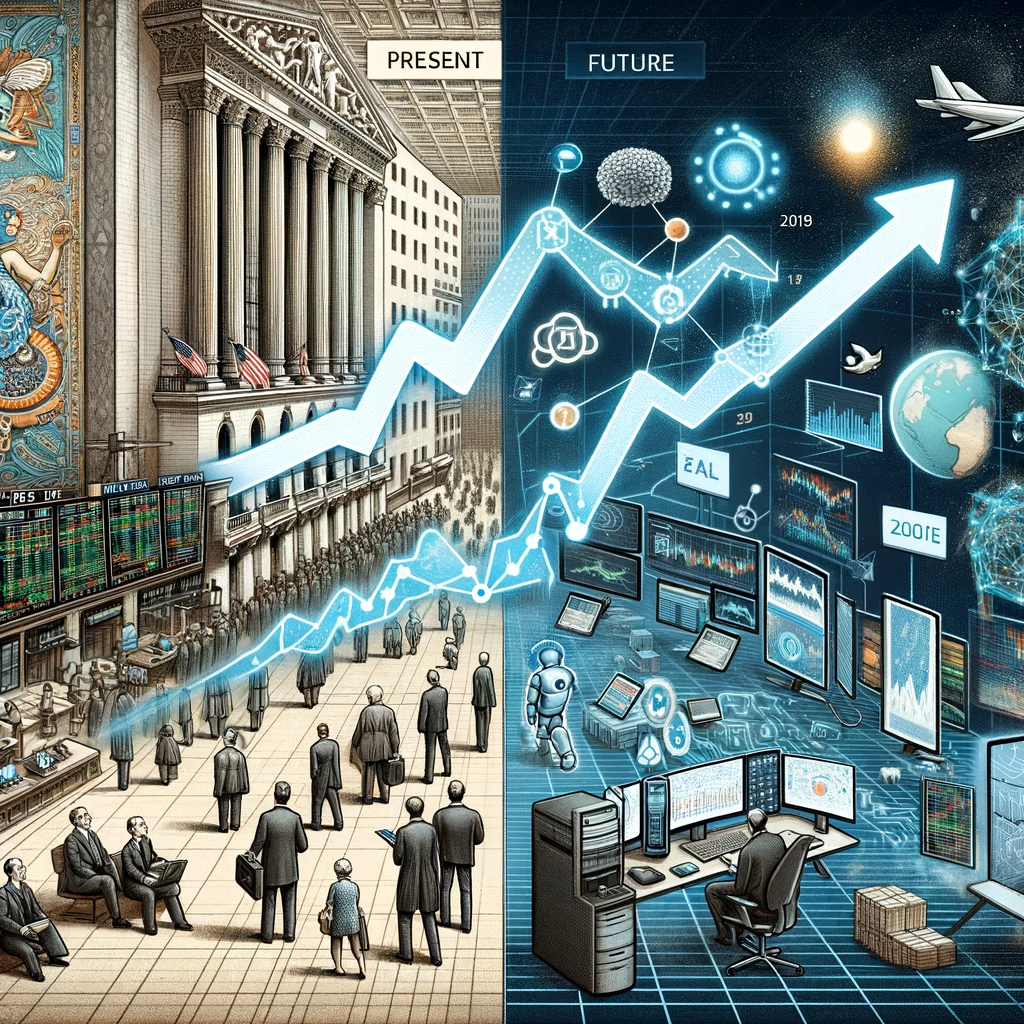

Overall, the journey of algorithmic trading from its early beginnings to its current state underscores the continuous interplay between technological advancements, regulatory changes, and market dynamics. As technology evolves, so too does the landscape of algorithmic trading, promising further innovations and developments in the future.

Statistical Data: Include statistics to illustrate the growth of algorithmic trading. For example, mention how, according to a report by J.P. Morgan, algorithmic trade orders accounted for 60-73% of all U.S. equity trading in 2019.

Algorithmic trading in India has seen significant growth and transformation, particularly since its introduction in 2008. Here’s an overview of the current state and future prospects of algorithmic trading in the Indian market:

Market Adoption: As of 2019, around 50% of equity trades in India were executed through algorithmic trading. This figure indicates a growing adoption of algorithmic strategies in the Indian financial markets, reflecting a shift towards more sophisticated and automated trading methods.

Regulatory Landscape: The Securities and Exchange Board of India (SEBI) has been instrumental in the adoption and regulation of algorithmic trading in India. Initially, algorithmic trading was permitted with the introduction of Direct Market Access (DMA) and was primarily limited to institutional investors. Over time, regulatory frameworks have evolved to ensure fairness and transparency in the markets.

Technological Advancements: The use of AI and ML in trading is becoming increasingly prevalent. While algorithmic trading relies on pre-defined algorithms set by humans, AI trading involves using artificial intelligence to analyze large amounts of data and make optimal trading decisions with minimal human intervention.

Challenges and Risks: Algorithmic trading, like any technology-driven approach, comes with its set of challenges and risks. Notable global incidents such as the Flash Crash of 2010 have highlighted the potential risks of algorithmic trading, including market manipulation and rapid escalation of losses.

Future Prospects: The future of algorithmic trading in India looks promising, with expectations of growth and more structured resources for traders. There’s an anticipation that resources for algorithmic trading will become more efficient as the market matures. This growth is likely to be supported by technological advancements and an increasing number of traders and firms adopting algorithmic strategies.

Regulatory Focus: With the growing popularity of algorithmic trading, there’s a consensus on the need for robust regulatory frameworks to manage risks and ensure market integrity. Effective regulation is essential to safeguard against potential market manipulations and to ensure the stability of financial markets.

The Indian algorithmic trading market is on a trajectory of growth and sophistication, driven by technological advances and a progressive regulatory landscape. As the market continues to evolve, it presents opportunities for traders and firms, alongside the need for vigilant regulatory oversight to mitigate inherent risks.

In the realm of modern trading algorithms, AI and machine learning have become integral in enhancing prediction accuracy and risk management. A study on stock market prediction using machine learning models demonstrates the effectiveness of various techniques, including decision trees, support vector machines, and neural networks, in analyzing financial data. These models can handle both structured data, such as historical stock prices, and unstructured data, like investor sentiments from social media or financial reports. This versatility allows for comprehensive market analysis and prediction.

The effectiveness of these models hinges on their ability to process and learn from large datasets, identifying patterns and trends that are not immediately apparent. For instance, neural networks are capable of summing up values of input parameters, taking into account their specified weights and biases, to predict stock market trends. Other models like the Random Forest algorithm use a series of decision trees to generate accurate predictions by analyzing uncorrelated groups of trees.

Such advancements in AI and machine learning have led to more sophisticated and accurate trading strategies, offering significant benefits in terms of speed, cost-effectiveness, and error reduction. However, with the increasing reliance on these technologies, it’s crucial to maintain a balance between automated and human decision-making to mitigate potential risks associated with high-frequency, algorithm-driven trading.

The ethical and regulatory considerations of algorithmic trading, especially in the context of India, involve balancing market efficiency with fairness and transparency. In India, the Securities and Exchange Board of India (SEBI) plays a crucial role in regulating algorithmic trading. SEBI’s regulations aim to prevent market manipulation and ensure a level playing field for all market participants, similar to the objectives of the MiFID II in Europe. MiFID II, for instance, focuses on increasing market transparency and protecting investors.

Ethically, the use of algorithmic trading raises questions about market fairness, especially in scenarios where high-frequency trading (HFT) firms gain advantages through faster access to information or trading opportunities. Ensuring that these technologies don’t create an uneven playing field is a key concern. Additionally, the potential for automated systems to amplify market volatility or participate in market manipulation, intentionally or not, is an area requiring rigorous oversight.

In India, SEBI’s guidelines on algorithmic trading include measures such as mandatory testing of algorithms and adherence to strict risk management norms. These regulations aim to prevent market disruptions and protect investors from potential risks associated with automated trading systems.

The future of algorithmic trading is poised for significant advancements, influenced by emerging technologies like blockchain and quantum computing. Blockchain technology is set to revolutionize the field with enhanced security and transparency, offering an immutable ledger for trading activities. This could significantly reduce fraud and errors while streamlining back-end processes. On the other hand, quantum computing promises to dramatically increase computing power and speed. Its implications for algorithmic trading are profound, potentially allowing for faster processing of complex models and real-time market analysis, which could lead to more efficient and profitable trading strategies.

Expert opinions in the field of algorithmic trading provide insightful perspectives on its evolution and future direction.

Firstly, the integration of AI and machine learning in algorithmic trading has led to the development of more sophisticated and adaptive algorithms. These technologies allow for the analysis of complex market patterns and conditions, enabling traders to respond more effectively to market changes. In the future, it is expected that machine learning will continue to shape algorithms, allowing them to autonomously adjust their strategies in real-time to match market conditions. This indicates a move towards more dynamic and intelligent trading systems that can learn and adapt on their own.

Regarding the adoption of algorithmic trading, it’s notable that trading firms, brokerage firms, retailers, and multinational investment banks are increasingly embracing these technologies. This widespread adoption has a domino effect, influencing various sectors and creating numerous opportunities for development and progress. The future of trading is expected to see a convergence of algorithmic trading with emerging technologies like quantum computing, blockchain, cloud computing, and the Internet of Things (IoT). These advancements could further revolutionize trading by introducing even faster speeds, improved security, and more robust infrastructure.

The role of regulation in algorithmic trading cannot be overstated. Effective regulation is crucial to prevent malpractices and misuse while also fostering innovation. In Europe, for instance, legislation has encouraged the automation of trading and transparency, which has contributed to the growth of algorithmic and high-frequency trading.

Finally, the future of trading systems looks very promising. With the ability to analyze vast amounts of historical data, future trading systems might predict market trends with high accuracy. They could operate across global markets, handling multiple accounts and strategies to spread risks. The possibility of these systems self-adjusting to market conditions could reduce the likelihood of market crashes and improve overall market stability.

Leave a Reply